What is Use Tax?

Use tax is a tax on the use, storage, or consumption of goods and services within a state. It is similar to sales tax, but it is applied in cases where sales tax was not collected at the time of purchase. The primary purpose of this type of tax is to ensure that state and local governments receive tax revenue on goods and services used within their jurisdiction, even if those goods and services were purchased outside the state or from vendors who did not collect sales tax.

Here’s why a company needs to self-assess use tax if their vendor didn’t charge them sales tax:

Compliance with State Laws:

Most states in the U.S. have use tax laws requiring businesses and individuals to pay use tax on taxable items if sellers did not collect sales tax at the point of sale. This ensures that states subject all taxable transactions to tax, regardless of where buyers made the purchase.

Equity Among Businesses:

It helps create a level playing field between in-state and out-of-state sellers. Without use tax, out-of-state sellers who do not charge sales tax would have a price advantage over in-state sellers who must charge sales tax. States started enforcing this much more as e-commerce started in the early 2000’s.

Audit and Penalty Avoidance:

States conduct audits to ensure compliance with tax laws. If a business fails to self-assess and pay use tax, it could face penalties, interest, and back taxes if an audit finds that tax was not properly reported and paid.

Vendor Non-Compliance:

Sometimes vendors, especially out-of-state or online sellers, may not be registered to collect sales tax in the buyer’s state. In such cases, the responsibility falls on the buyer to self-assess and remit the use tax.

In summary, when a company makes a purchase and the vendor does not charge sales tax, the company must calculate the amount of use tax due based on the purchase price of the taxable goods or services and remit this amount to each state’s tax authority. This process ensures that buyers pay the appropriate tax on all taxable transactions, regardless of how or where they made the purchase. If you don’t do it, you are liable for, plus penalties and interest it if audited.

How Use Tax Affects Purchasing Company Swag and Apparel

Let’s face it: figuring out sales tax, calculating it for all states, and remitting it is a big job. The software needed for this is expensive, and the time and effort required often necessitate a full-time employee. Most promotional products companies lack the resources for this and don’t have to collect sales tax in states where they don’t have nexus, yet they can ship products anywhere you request. For small distributors, this typically isn’t an issue.

However, if your company ships to multiple states, this quickly becomes relevant and opens you up to liability. Many companies are unaware of this requirement and don’t consider it when selecting vendors to run their online company stores. Typically, the focus is on finding a vendor to provide swag and uniforms, not on tax compliance. Most don’t even know to ask this question when evaluating vendors.

The problem is that your company’s accounting and tax team must report use tax in the states where they have physical or economic nexus on all swag purchases where they did not pay sales tax. This shifts the burden from the vendor to your company. If your company doesn’t self-assess and auditors review it, they could require you to pay use tax on purchases for three to seven years (it varies by state). This creates a significant burden on your accounting team to figure it out and remit the tax, and failing to do so can be very expensive during an audit.

Solution – Select the Right Vendor

When looking for a vendor to build, manage, and run your online company store, ask this question. “Are you set up to collect sales tax in all states?” It’s a simple question with a straightforward answer. If they are not, you might want to keep looking. Professional companies that run online company stores correctly set up systems to collect sales tax in all states. This is a service that saves you significant time and possible liabilities. Your accounting team and lawyers will love you for finding a vendor that handles this for you.

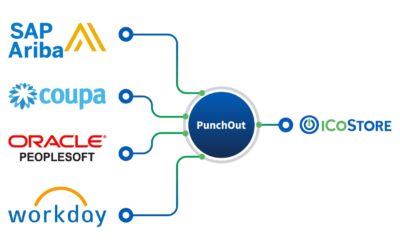

At iCoStore, we have integrated Avalara into our stores and Microsoft Dynamics ERP system. This allows us to collect sales tax in all states that have sales tax. This ensures compliance and removes the burden from your accounting team, allowing you to focus on what you do best.